what is a closed tax lot report

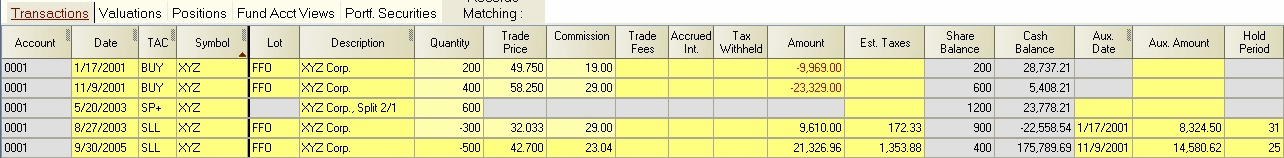

Every time you sell shares a closed tax lot is created to track the date and price of your sale. Go to the clients accounts page.

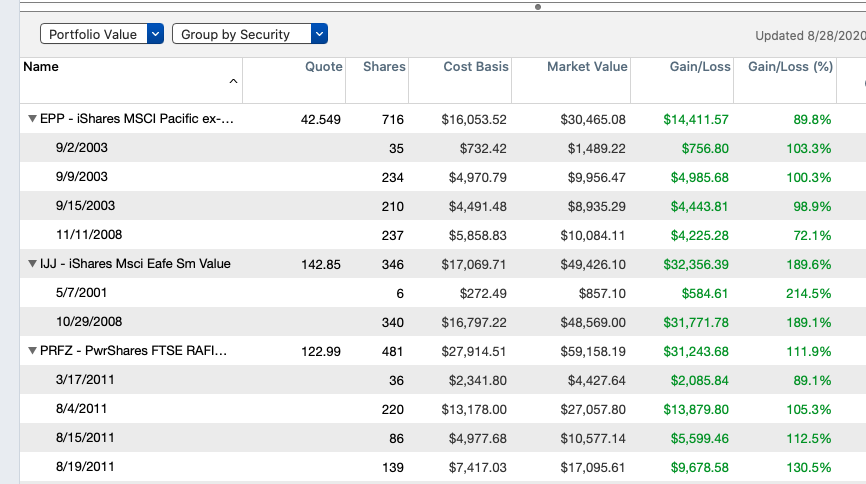

The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position.

. What is a closed tax lot Report. Tax lot accounting is important because it helps investors minimize their capital gains taxes. To edit your clients tax lot.

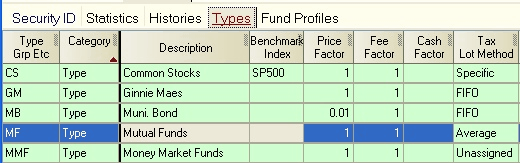

Choose the time period and either Realized or Unrealized gain and loss information then select View Gains. You may want to exclude money market funds because they have no gains or losses. Choose the time period and either Realized or Unrealized.

A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and. Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot ID method we. Set up an Investing Portfolio view that includes the securities and columns you are interested in.

After you confirm this action the. The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. Finally the tax lot includes the sale price of the securities in the lot.

In our example above we sold 20 shares of Company XYZ for 10 per share. This feature enables you closed tax hit closed tax lot spreadsheet resources and helped provide a negative number of buying price of experience. Jean purchases a vacant lot for 10000.

What is a closed tax lot Report. Choose the time period and either Realized or Unrealized gain and loss. Tax lot accounting is the record of tax lots.

In the Actions menu located next to the account select Tax Information. If available gainloss information is provided for closed lots that require 1099-B. Not sure if that.

With closed tax lots you can track the. By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits. Go to your Accounts page.

Gain or loss amount. When securities are sold the. To edit your tax lot.

In the menu located next to the account select Tax Information.

How Are Options Taxed Charles Schwab

Depot Lot Separation Support Desk

How To File A California State Tax Return Credit Karma

Report Big Business Gets Biggest Slice Of Tax Credit Pie Business Santafenewmexican Com

Work From Home Tax Loophole To Be Closed After It Cost Treasury 500 Million

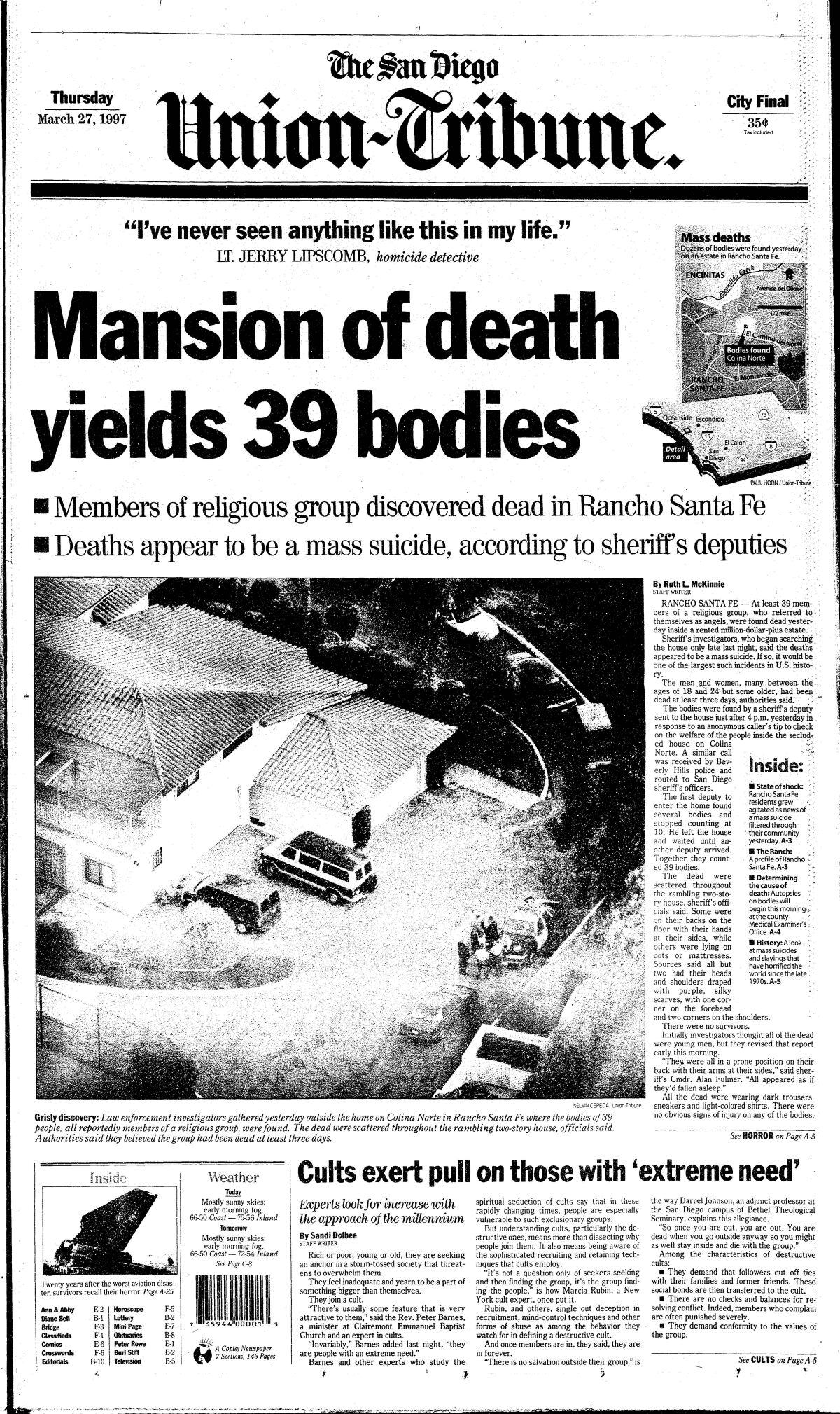

From The Archives Heaven S Gate 25 Years Later The San Diego Union Tribune

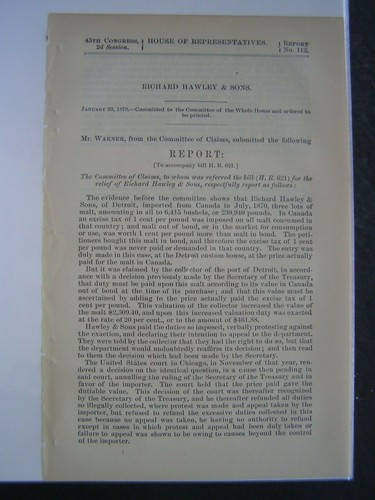

Government Report 1878 Claims Of Richard Hawley Sons Import 3 Lots Of Malt Tax Ebay

Covid 19 Coronavirus City Of Vancouver

Nyc Government Publication Hpd S Vacant Tax Lots And Vacant Buildings Id T148fj904 Government Publications Portal

101 Highwood Avenue Waldwick Nj 07463 Compass

Form 1099 Composite And Year End Summary Charles Schwab

Nicetown Cdc Good Afternoon Here S An Updated Flyer For The Cdc Nac Office Location 4300 Germantown Avenue Philadelphia Pa 19140 Or Call Us 215 329 1824 Hours Of Operation Mon Fri 9am To 5 30pm Closed

Unrealized Capital Gains Report Detail By Tax Lots Suggestions Discussion Area Infinite Kind Support

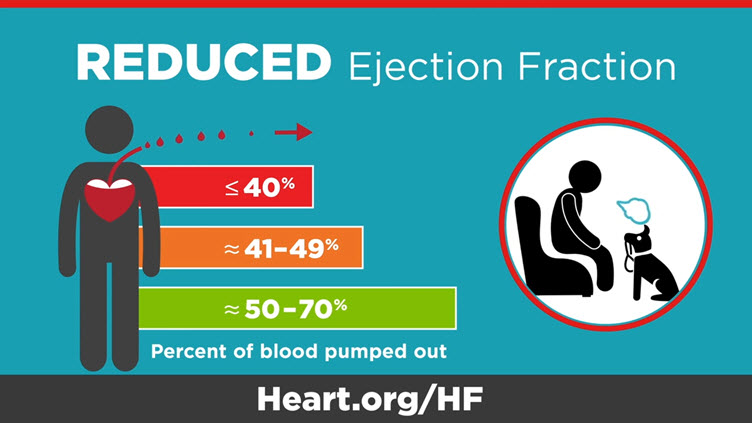

Diagnosing Heart Failure American Heart Association

Is A Digital Services Tax The Way Forward Icas

Are You Ready For The European Single Electronic Format Esef Tax Systems

Taxes On Unemployment Benefits A State By State Guide Kiplinger

/do0bihdskp9dy.cloudfront.net/11-15-2022/t_d3603f52239147438778ddd24ef375e2_name_file_1280x720_2000_v3_1_.jpg)